A framework for automating KYC/KYB for fast-growing fintechs

It’s common for startups to start with human-in-the-loop risk management processes to get to market quickly, but as a new product or feature gains traction, these manual processes can soon become a bottleneck to growth.

Welcome to Scaling Fintech, a content series by Parcha that examines how fast-growing fintechs use automation to scale more efficiently and reach more customers. Over the last year, we’ve spoken to dozens of banks and fintechs about how they are tackling the challenges of an ever-changing compliance and risk landscape while efficiently scaling their customer base. This content series shares the best practices we’re hearing from customers and thought leaders in the ecosystem and our experience leading risk product and engineering teams at hyper-growth startups.

The importance of building scalable risk management systems

Whether you’re an early-stage startup or a growth-stage fintech, taking a systematic approach to automating your risk management is critical to helping you scale. Why? Risk controls sit at the heart of everything a customer does on a fintech platform, from when they onboard to when they move money or send/receive payments. These controls are critical to keeping your customers and business safe and meeting regulatory requirements. It’s common for startups to start with human-in-the-loop risk management processes to get to market quickly, but as a new product or feature gains traction, these manual processes can soon become a bottleneck to growth.

Based on our experience leading risk teams at hypergrowth fintechs and conversations with our existing and prospective customers, we share a framework for automating KYB/KYC that any fast-growing fintech company can apply. We’ve included recommendations for vendors at each layer that are most commonly used by the dozens of fintechs we’ve spoken to.

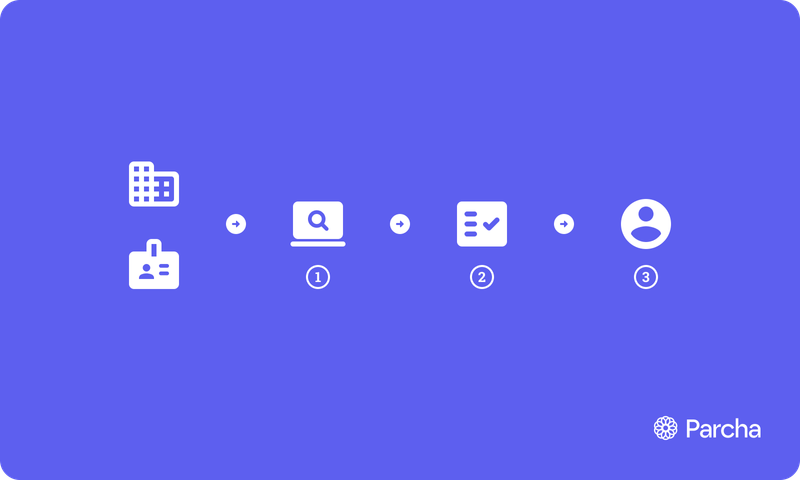

The Three-Layer System of KYC/KYB Automation

Here’s how the three-layer system works at a high level:

Layer 1: Verification Sources

Verification sources form the foundational layer for KYC and KYB processes. They allow a fintech to perform the essential verifications required during customer onboarding through data integrations. These data sources validate the identity of businesses and individuals to ensure they are who they claim to be. Verification at this stage typically includes confirming government-issued IDs, assessing the risk associated with an email address, verifying social security numbers (SSNs) or tax identification numbers (TINs), determining if a business is registered and still active, and screening companies and individuals against sanctions lists and watchlists. A robust set of verification sources is crucial for laying the groundwork for the subsequent decisioning and workflow automation layers.

Example Verification Solutions:

- Persona: Delivers identity verification with document authentication and biometric analysis.

- Socure: Utilizes predictive analytics to verify identities in real-time.

- Au10tix: Provides instant customer onboarding with ID verification and selfie biometrics.

- Onfido: Specializes in AI-based document verification and facial biometrics for user authentication.

- Emailage: Combines email risk assessment with broader identity verification solutions.

- LexisNexis: Offers a range of identity verification and risk assessment tools, including SSN and TIN checks.

- Thomson Reuters CLEAR: Provides accurate and comprehensive verification of personal identifiers like SSNs.

- ComplyAdvantage: Global sanctions, watchlist, politically exposed person, and adverse media lookups.

- MidDesk: TIN checks and the latest registration status foi US businesses.

These vendors provide various services to ensure a thorough and reliable identity verification process, which is a prerequisite for any financial institution's onboarding and compliance procedures. By deploying these verification sources, fintech companies can significantly enhance the integrity and security of their customer onboarding flow and reduce the risk of fraudulent actors onboarding. Some of these vendors, like Persona, also provide orchestration and workflow automation services, so if you are looking for an all-in-one solution, it’s worth asking what they offer beyond verifications.

Layer 2: Orchestration and Decisioning Systems

Orchestration and decisioning systems for KYB and KYC are critical for fintech companies. They provide automated risk assessments by analyzing the data collected during customer onboarding from all the different data sources in Layer 1. Furthermore, they offer configurable rules-based systems that decide how each customer should be handled from a fraud/compliance perspective, depending on the data inputs. The best vendors use machine learning models that analyze hundreds of signals, including behavioral biometrics, to determine fraud and compliance risk.

Example KYB/KYC-focused Vendors for Decisioning Systems:

- Alloy: Identity, rules-based decisioning platform that automates KYC, KYB, and AML processes, using a wide range of data sources to make real-time decisions.

- Sardine.ai Fraud prevention and compliance solutions that use AI and machine learning to detect and prevent fraud in real time, including during the KYC process.

- Trulioo: Global identity verification service that leverages advanced analytics to provide KYC and AML solutions, ensuring compliance and mitigating risk.

- GBG: Identity management solutions that include document verification and biometric checks.

- Sift: Fraud detection and prevention platform that uses machine learning models to analyze user behavior and detect fraudulent activity.

These vendors offer platforms that integrate various data points and verification checks to streamline the decision-making process for customer onboarding. By utilizing such systems, fintechs can efficiently manage risk by automatically approving (or denying) as many customers as possible without human intervention.

Layer 3: Workflow Automation Tools

When a decision can’t be made automatically with a layer-2 orchestration and decisioning solution, the customer is placed into a manual review where a human compliance analyst reviews and decides the case. Common reasons for this are when there is an issue with reading an ID, the business is too new to appear in state or federal registrations, the customer provides incorrect information in their application, or there is a sanctions, watchlist, PEP, or adverse media hit. Workflow automations are designed to assist with this manual review process. These tools optimize the efficiency of human reviewers by automating routine tasks and organizing the flow of work. Many fintechs build internal systems for automating workflows or use platforms like Retool, but there are great out-of-the-box tools, too.

Example KYB/KYC-focused Vendors for Workflow Automation:

- Hummingbird: Streamlines anti-money laundering and KYC compliance processes, offering case management and regulatory reporting tools.

- Unit21: No-code platform that enables companies to manage risk, compliance, and fraud through customizable workflow automation.

- Effectiv: Automation for business onboarding, including UBO verification and adverse media

- Parcha: AI that automates KYC/KYB compliance reviews following the same process as a human but ten times faster and cheaper.

By incorporating workflow automation tools from these vendors, fintech companies can ensure that the necessary human reviews are conducted efficiently and consistently, addressing any red flags or complex cases that arise during the onboarding process. Furthermore, with the new crop of AI automation products in this space, like Unit21’s copilot or Parcha’s own AI automation for manual reviews, there are more efficiency and cost savings to be gained.

Top 5 considerations for KYC/KYB automation

Here are our top 5 points to consider when you approaching any type of automation for your KYC/KYB processes

- Do your research: Before committing to any system or vendor, it’s worth doing your homework to understand the pros and cons of each solution and how it fits with your existing onboarding flow. For example, some solutions require that you use their branded user flows to capture government ID images, while others let you capture them yourself and send them via API.

- Plan and measure: Overhauling your onboarding processes can be a big undertaking, so it’s helpful to plan ahead and set a timeline along with critical milestones and metrics you want to track.Some metrics to consider tracking are manual review rates, activation rates, fraud losses and negative customer feedback

- Build iteratively: Changing your onboard processes can have a significant impact on your businesses, both positive and negative. If you make many changes simultaneously and then see a negative impact on growth metrics, it’s hard to understand why. It’s always a good idea to take an iterative approach, adding new vendors or layers one at a time, ideally with A/B testing if you have enough volume so you always understand and can isolate impact. If you have enough historical data you can also backtest vendors to approximate impact on critical metrics like approval rates.

- Buy before you build: It’s often tempting as a startup to build things in-house. Before making a big investment it’s worth considering the vendors you can leverage first. For example, using an in-house machine learning model is probably not the right approach for most early-stage startups. Instead, leverage the expertise of ML teams of companies like Sardine, Sift, or Unit, who have off-the-shelf models that are ready to customize.

- Use AI to unlock more automation: Today, using modern AI solutions like Parcha, you can automate manual KYC/KYB reviews that previously required human judgment and expertise. This option is worth considering, especially if you are scaling quickly and your human manual reviews become a bottleneck.

Where Parcha's AI fits in

Parcha is an AI-powered compliance suite that automates manual KYC and KYB reviews. We accelerate those time-consuming manual reviews needed in layer 3 when your existing vendors can’t confidently approve or deny a customer. Parcha uses the latest large-scale language models to simulate how a human compliance analyst would complete a manual review, but it is ten times faster and cheaper, with none of the scaling constraints of a human team. Parcha can complete over a dozen manual checks using AI, including sanctions, watchlist, PEP, adverse media alert screening, business document validation, and online due diligence. Parcha also provides a detailed AI-generated audit log for every manual review check we do.

Summary

At the heart of scaling effectively in the fintech sector is robust KYC/KYB automation. By automating your KYC processes, you streamline customer onboarding and significantly scale your operations while maintaining compliance with regulatory standards. Our three-tiered automation framework—Verification Sources, Orchestration and Decisioning Systems, and Workflow Automation Tools—enables fintechs to manage increased customer volumes effortlessly. This system ensures that your risk management scales with your growth, reducing bottlenecks and enhancing overall operational efficiency.

Looking to elevate your fintech's automation capabilities? Our team at Parcha has deep expertise in designing and implementing scalable KYC/KYB systems. We’re here to help you automate and optimize your processes for better scalability and efficiency. Feel free to reach out for guidance on building a progressive AI-powered KYC program tailored to your growing needs.