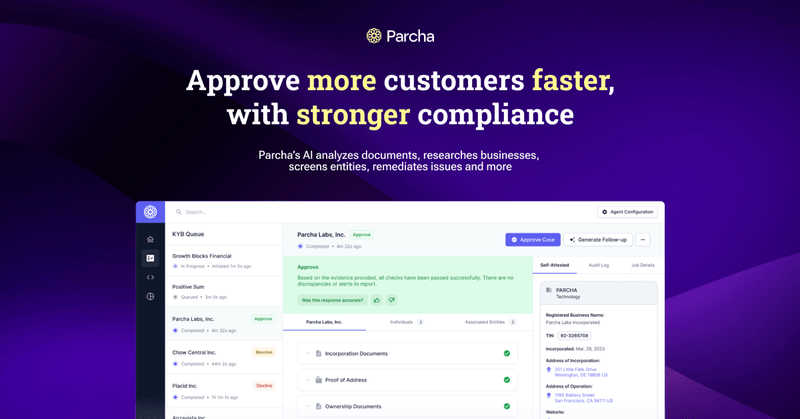

Approve more customers faster, with stronger compliance using Parcha

Parcha’s AI KYB and KYC solution for global banks and fintechs approves more customers faster, with stronger compliance.

The first AI suite to fully automate compliance reviews for banks and fintechs

We founded Parcha almost a year ago to enable regulated businesses to scale more efficiently using AI by automating their compliance and operations workflows. Since then, we’ve spoken to dozens of banks and fintechs serving thousands of businesses worldwide. The most common pain point we’ve seen in their compliance and operations process is the manual work required to complete Know Your Business (KYB) reviews during onboarding. But what makes KYB so hard to automate?

We identified three major points of friction:

- Document validation and verification - Reading and validating incorporation, business ownership, and address documents is the most time-consuming part of the KYB process, especially because official documents have a variety of formats in different jurisdictions. If the documents aren’t in the reviewer's native language, this process becomes doubly difficult.

- Due diligence and screening of businesses and beneficial owners - Understanding the risk profile of a business is critical in AML, including open source intelligence (OSINT), screening against sanctions, and the watchlist. What makes this process time-consuming is businesses that have little to no online presence or those that have a common name, triggering false positives.

- Additional information requests and remediation of incomplete cases - Often, a customer will not provide accurate information or documentation to complete the onboarding process. The back and forth of getting the right information from customers is resource intensive, and worse yet, it’s a horrible onboarding experience.

The problem with these manual processes is that they slow down the time it takes to onboard customers, reducing the likelihood of conversion. In addition, the more customers you have, the larger your compliance and operations team needs to get. We estimate that manual compliance reviews cost the industry almost ten billion dollars in labor and lost revenue.

Introducing AI-powered compliance reviews

Today, we’re excited to introduce the first AI-powered solution for fully automating manual compliance reviews starting with KYB and KYC. Parcha’s AI KYB and KYC solution for global banks and fintechs approves more customers faster, with stronger compliance. In three minutes, Parcha can carry out over a dozen compliance checks to automatically determine whether to approve or deny a business while providing a detailed audit log of its reasoning. That’s ten times faster than it would take a human, on average, to carry out the same review — and at a fraction of the cost.

In speaking to dozens of fintech companies and working closely with our design partners, we’ve seen three pain points come up time and time again with KYB that we’re solving: validating and verifying businesses documents, carrying out online due diligence to determine the risk of a business and remediating cases that require further information.

If you are serving customers across the world, you need to be able to read, validate, and verify documents such as business registrations, articles of incorporation, and proof of address in different formats and languages. We use a combination of fraud detection, OCR, and AI to verify, translate and validate documents in 60+ languages.

It’s critical to determine the risk a business might pose to your platform. Our AI carries out comprehensive online due diligence on a business to determine what it does, what product / services it provides, what industry it is in, and what countries it operates in. In addition, we carry out sanctions, watchlist and adverse media screening to provide a complete risk assessment of the business, which can be customized to meet your risk framework.

Our AI-powered remediation system that enables you to close the loop with your customers when a review requires additional information. This enables you to make decisions on customers faster, leading to higher conversion, a better customer experience, and faster time to revenue. Because in this environment, every customer counts.

Parcha is faster, more scalable and more compliant

Parcha completes an onboarding compliance review ten times faster than a human, which means customers can be approved in near realtime. Unlike a human team, the platform scales up and down automatically depending on onboarding volume so understaffing or overstaffing is no longer a problem. Finally, with a fully customizable workflow and is easy to update when policies change and audit logs for every step taken by the the AI, Parcha gives you more control than you’ve had before.

“Parcha has quickly become an integral part of our onboarding processes, especially regarding the most time-consuming task: onboarding business clients. Doing KYB without Parcha is more challenging and takes significantly longer to perform.”

-Romeo Ju, CEO of Bancoli, a US registered and licensed bank.

Parcha is now SOC 2 Type 2 compliant

Security and privacy are our highest priority which is why we’re excited to share that Parcha is now SOC-2 Type 2 compliant. Our customer’s privacy and security are our top priorities and besides being SOC-2 compliant we also provide every customer with their own dedicated instance of our product which supports SSO. For enterprise customers we can also provide an on-prem solution and the ability to bring your own LLM model. Learn more in our trust center.

Ready to get started?

If you’re interested in using Parcha to onboard more of your customers faster with stronger compliance, we can get you started in our demo sandbox. You can schedule a demo here:

https://parcha.ai/demo