Why we founded Parcha

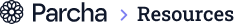

A deeper dive into why we're building AI agents to supercharge compliance and operations teams in fintech at Parcha

Hi Hitchhikers!

First, welcome to the new subscribers who hitched a ride with us this week! Last week I shared the news that I’m starting a new startup Parcha in the AI space and said I would follow up with more details soon. As promised, this week, I wanted to share the story behind Parcha and why we’re so excited about building AI agents to supercharge businesses.

Before I jump into this week's post, I have an exciting announcement:

On June 6th, The Hitchhiker’s Guide to AI and Parcha are co-hosting an AI dinner with our friends over at Hireflow.ai. If you’re based in SF and are either actively building something in AI or are interested in meeting other engineers exploring AI, we would love to meet you! We have limited spots, and are prioritizing AI hackers/engineers. If you’re interested, RSVP for the dinner here ASAP and we will get back to you.

On to this week’s update…

In this post, I will talk about the problem our new startup Parcha is solving, how AI enables a solution, and how we plan to differentiate from the competition. Let’s jump in!

Fintech’s scaling problem

When I started this newsletter just under six months ago, my goal was to help people that was to share my insights with other people that were new to the space, like myself. My inspiration for writing was from Paul Graham, the founder of YC and prolific essay writer who once said that “writing is a form of thinking.” Writing about AI would help me think about the space and where I might fit in.

You may not know that before writing this newsletter, I had been in product management for over a decade, most recently in fintech at Coinbase and Brex. I joined Coinbase as the second PM hired to work on the consumer app at the height of the 2017 crypto bull run. During that time, I saw Coinbase 5X in size, experienced the depths of the crypto winter, and learned how money movement, compliance, and fraud prevention worked at a hypergrowth fintech company.

Even though you might think of Coinbase as a crypto company, most transactions on the platform at the time were between fiat and crypto. That meant money moving between credit cards and bank accounts through the traditional financial system, which was and still is far less technologically sophisticated than you might expect. In fact, every day, there was a team of operations folks at Coinbase that would manually process incoming wires in Coinbase’s bank account to make sure the money matched up to the correct Coinbase customer accounts to fund their crypto purchases!

Later when I joined Brex, a fintech company providing corporate credit cards and cash management accounts for startups, I was surprised to see a similar story. This time it was teams of operations folks manually reviewing customer applications, making underwriting decisions for credit limits and manually processing customer’s check deposits. In fact, in the early days of Brex Cash, the bank-account replacement product I helped launch, if you wanted to deposit actual cash into your account, your best bet was it mail it to HQ!

We did try to automate as many of these manual workflows at possible at Brex. My co-founder Miguel and I led a team of ~200 PMs, engineers, designers, data scientists, and cross-functional partners tasked with overhauling Brex’s onboarding, compliance, fraud, and underwriting systems. We made a lot of progress and helped the company scale its customer base 10X in a year. However, many manual workflows remained and were eventually outsourced to a third-party contractor or Business Process Offshoring (BPO) service. The challenge with these services is their agents churn a lot, they require a lot of upfront investment in training and you need to give the vendor access to internal tools and sensitive data.

Isn’t this just an excellent example of Y Combinators’ mantra of “do things that don’t scale?” After all, both Brex and Coinbase were YC companies. But in reality, in the zero-interest rate environment, we were in for the last decade, this approach of having armies of operations people doing a lot of manual work did scale. Many fintech companies like Brex and Coinbase have grown aggressively with armies of operations people working tirelessly behind the scenes to keep money moving smoothly, mitigate risk, and manage compliance.

The problem with this approach is that, unlike software, these operations backends in the fintech industry scale linearly at best. The more customers you have, the proportionally larger your team needs to get.

Fast-forward to today, these same fintech companies are under immense pressure to lower costs and extend their runway to ride out the current economic uncertainty, ideally by becoming profitable. That usually means that headcount has been frozen or reduced even as customer growth continues. But as I said earlier, these teams scale linearly, so at some point, you hit a ceiling on how many customers you can serve.

In my post on navigating the AI landscape to where I identified opportunities for AI startups, I said the following:

“There might be industries that are both fragmented and have knowledge workers who carry out repetitive software-based workflows. These industries are probably ripe for disruption because (1) there's no dominant player that has a structural advantage, and (2) repetitive workflows can be quickly augmented with AI.”

From my own experience, I haven’t seen any dominant players today that own workflow automation in compliance and operations in fintech and, more broadly, in finance. This is a perfect example of the type of problem that I think is an excellent opportunity for an AI startup. Then last month, a critical innovation in AI unlocked the solution: autonomous AI agents.

AI Agents unlock intelligent automation

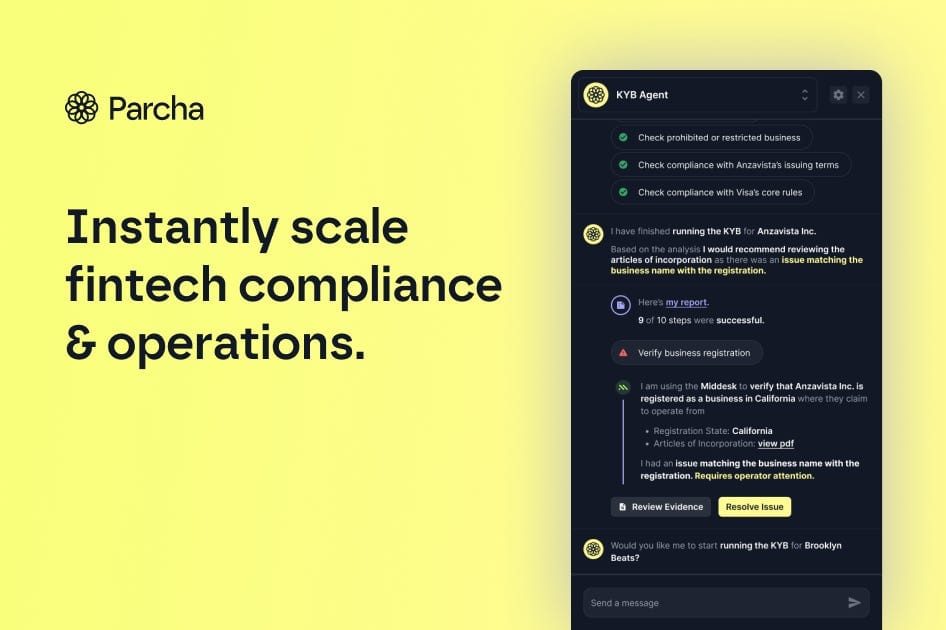

The emergence of large language models, such as GPT-4, has enabled AI models to perform chain-of-thought reasoning. This means an AI model can follow multiple steps, create an internal model of what is happening in a scenario, and reason through it to get to a solution (see example below).

This chain of thought reasoning is so impressive that we can now create autonomous AI agents that can complete tasks in sequence, using tools to solve problems, as I covered in my previous posts on autonomous AI agents like BabyAGI:

“I believe there is a more profound implication for these types of iterative, LLM-powered autonomous AIs that can use other tools/models to complete tasks. It feels much closer to how humans interact with the world, whereby we have additional sensory input beyond our brain’s intelligence, and we use tools to complete our objectives.”

Many knowledge workers today perform repetitive work that has to be done by humans due to nuances in language, analysis, and steps that are hard to automate, even if they are very repetitive. The emergence of AI agents will change how these tasks are done. AI agents can carry out tasks like manual reviews in fintech, which would take humans several minutes or hours to complete, and can now be completed in seconds. But it’s not just time being saved. AI agents are more scalable (up and down), easier to audit, faster to train, and cheaper to run than humans carrying out the same tasks. They can make existing human teams far more productive too.

At Parcha, we are excited to be at the forefront of building these agents. Our platform empowers existing operations teams by supercharging them with AI agents. This will enable them to do more work and no longer scale linearly. One person can now manage dozens, if not hundreds, of agents. Our platform is unique because how you create and deploy agents is approachable to nontechnical folks. All you have to do is give our agents the same policies, procedures, and training docs you give a new team member and access to the same tools. That’s it!

Once you have deployed these AI agents, you can monitor, manage, scale up, and scale down your digital workforce from one central dashboard. Because all the agents share context, you connect them together to complete larger, more complex tasks too, much like you run a multi-layered organization today.

Open-source models and enterprise

The final piece of the puzzle that makes Parcha possible is building an enterprise-grade product that prioritizes privacy and data security, a critical feature for finance use cases. The reality is, most enterprise companies are not comfortable with handing over their data to OpenAI.

Enter open-source models…

Open-source versus closed-source models are a hot topic in AI and very relevant to enterprise use cases. At an AI event I attended, Greg Brockman, CTO of OpenAI, recently shared his belief that closed-source models will continue to be most centralized and at the bleeding edge, while open-source models will be about one to two years behind. In a previous post, I also thought there would be a divergence between open-source and closed-source models:

Over time though, open-source will probably lag behind proprietary models for three primary reasons:

- Cost to train: As models get bigger and bigger, they will become more expensive. Open-sourced models will therefore need more well-funded sponsors to develop them. Today StabilityAI might be able to afford to sponsor a GPT-3 equivalent model that costs $10M to train, but next year they might not be able to afford to support a GPT-5 equivalent that costs $100M to train.

- Proprietary datasets: Well-funded companies like OpenAI license additional private data sets to improve their models. This will make it harder for open-sourced models to compete on performance and they may lag one or two generations behind proprietary models. For many customers, the price and versatility of open-sourced models will be the deciding factor. Using a lesser performant open-source model will be a path many developers take to get started cheaply before developing their own models or switching to proprietary ones once they have enough scale.

- Closed research: Many contributions that have enabled open-source AI models to come from private companies, like Google’s Transformer architecture. That might change as the need for Big Tech to compete in AI takes a higher priority over publishing research.

After seeing the sheer pace of innovation in the open-source AI community since Meta’s release of LLAMA though, I’m now far less convinced that open-source will lag far behind proprietary closed-source models. It's no longer clear to me that just having more data at this point and more parameters will solve the problem. There may be other innovative and exciting ways that we can improve language models beyond that, which the open-source community may find and experiment with just as quickly as a closed-source community in the big research labs.

In fact, it seems increasingly likely that language models will follow a similar path to open-sourced generative image models like Stable Diffusion. This collective momentum of the AI community, along with many companies now releasing their own models like MosaicML and Databricks, is really accelerating open-source innovation. This is reflected in a recently leaked memo by a Google employee titled “We Have No Moat, And Neither Does OpenAI":

While our models still hold a slight edge in terms of quality, the gap is closing astonishingly quickly. Open-source models are faster, more customizable, more private, and pound-for-pound more capable. They are doing things with $100 and 13B params that we struggle with at $10M and 540B. And they are doing so in weeks, not months.

While close-source model creators like Google still have a huge advantage in distribution and existing ecosystems, open-source models will be an excellent option for startups developing AI products for end consumers with stricter privacy or security requirements. Furthermore, open-source models can the fine-tuned to better fit a particular vertical use case, with far fewer parameters.

Open-source models, therefore, become an excellent option for startups building for enterprises in regulated industries, like fintech and finance. Being able to control the data around the models, optimize their output, and deploy them on custom infrastructure that prioritizes privacy and security makes open-source models a great fit.

At Parcha, we’re developing fine-tuned models based on open-source LLMs that can easily be deployed in an enterprise setting. We believe this approach will be a differentiator in the long term because we will have better control over our agent’s capabilities, and most importantly, our customers will have better control over their data.

Lastly, there is timing…

When starting a startup, there’s one factor you often can’t control: timing. I will never forget a piece of advice I once heard from a partner at Sequoia Capital at a YC dinner I attended over a decade ago when I was doing my first startup. The advice went something like “If there’s a wave that can give your startup momentum, you should ride it.” The idea is that it’s hard enough doing startups as it is, and you should take advantage of any tailwinds you can get. AI is the most important technology wave we have seen since mobile, and I believe the magnitude of its impact will far surpass any predecessor. Coupling this with the need for enterprise companies to be under pressure to manage costs and find more efficiencies, it feels like an opportune moment for AI-powered automation.

I always knew I wanted to start a startup again at some point in the future. After spending six months on the shore watching the AI wave gaining momentum, I knew it was the right time to grab my surfboard, and luckily, my cofounder Miguel was ready to paddle out with me too.

Thanks for reading this update. If you’re considering starting an AI startup, I would love to hear from you - I’m happy to share what I’ve learned so far. If you’re curious about joining an AI startup, we’re hiring at Parcha and would love to hear from you too!

Next week we will go back to our regular programming, breaking down how the latest developments in AI will change how we live, work, and play.

P.S. Don’t forget to subscribe!

Thanks for reading The Hitchhiker's Guide to AI! Subscribe for free to receive new posts and support my work.